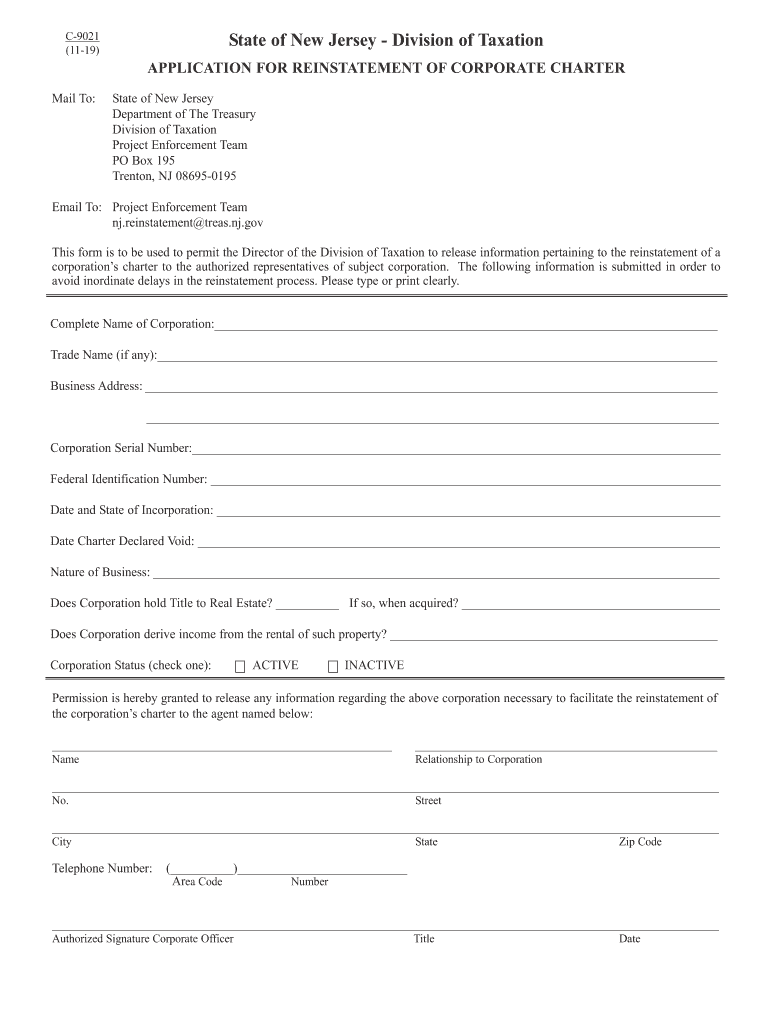

Who needs a form C-9021?

Form C-9021 is an application for the reinstatement of a corporate charter in the State of New Jersey. Business owners or corporate authorities have to file this form in order to allow the reinstatement process for the subject corporation.

What is form C-9021 for?

There are many reasons to apply for reinstatement. This particular form serves for companies operating in New Jersey. When the state official at the Division of Taxation receives this application and approves, he has to disclose all the necessary information for the reinstatement process to the selected agent.

Is it accompanied by other forms?

It doesn’t require additional forms.

When is form C-9021 due?

There is no due date for this application, it is filed whenever you want the voided or revoked business to be reinstated.

How do I fill out form C-9021?

It will not take much time to fill out this form. Write the company title, its trade name and business address, corporation serial number, federal identification number, the date and state of incorporation, the date charter declared void and its nature of business. Answer if the corporation holds title to real estate and if the corporation derives income from the rental of such property. Add the information about the selected agent, and you’re done.

Where do I send form C-9021?

The correct mailing address is:

State of New Jersey

Department of the Treasury

Division of Taxation

Corporate Services Audit Group

PO Box 277

Trenton, NJ 08695-0277

Or fax it to Corporate Services Audit Group (609) 292-3467